Jump To:

If you lined up every household in the Raleigh area in order from least to most income, the area median income (AMI) is the amount in the middle.

AMI is used to determine eligibility for affordable housing programs. These programs are targeted to households earning below 80% AMI, with some programs intended for lower AMI levels.

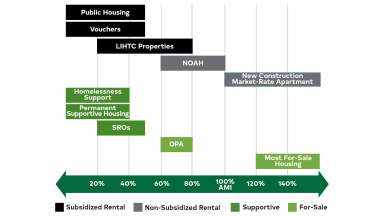

We can think of the affordable housing landscape as a continuum that shows the range of affordable housing options available to residents:

The City's affordable housing programs focus primarily on the development of affordable rental units as well as support for homelessness initiatives and first-time homebuyers with low incomes.

Affordable Rental Development

The construction of affordable rental housing requires capital, just like any other development. However, the rents must be affordable to families earning lower incomes. Affordable units are made accessible primarily through the Low-Income Housing Tax Credit (LIHTC) and Housing Choice Voucher (Section 8) Program.

LIHTC development is the most widely used tool to create affordable rental units. It subsidizes the acquisition, construction, and rehabilitation of units through financing (debt and/or equity).

It is a multi-year process. It can be challenging for funders to commit dollars to a project until all other funding sources are solidified. The development review process at the local level can be lengthy, with construction or rehabilitation of housing taking 18 months to a year depending on the project size.

| Start: Project Conception | Year 1: Pre-Development | Year 2: Construction | Year 3+: Completion |

|---|---|---|---|

|

|

|

|

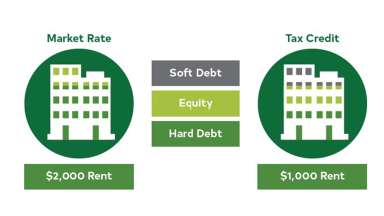

Layered financing through LIHTC equity and soft debt (like low-cost loans) reduce the hard debt, thus allowing monthly charged rents to be lower.

LIHTC is a tightly regulated program with:

- Limits on contractor profit.

- Specific reserve amounts.

- Underwritten to 1.15 debt coverage ratio.

- Independent cost certification upon completion of construction.

- Legally binding 30-year affordability period through deed restrictions.

The City contributes millions of dollars per year to support the development of affordable rental housing (nearly $17 million is budgeted for FY23-24). As of 2023, the current average subsidy required to create one rental unit affordable at 60% AMI is $159,000.

Developers building market-rate rental housing have more flexibility and higher profit margins than LIHTC developers:

- Profit achieved when the project is built, occupied, and sold.

- To create affordable units in a market-rate development, the $159k subsidy must come from somewhere

Tools that the City can use to incentivize affordable units in market-rate developments include inclusionary zoning and financial subsidy.

Project Spotlight: Washington Terrace

Washington Terrace is an aging 23-acre, 245-unit housing project for households with low incomes. It is in east Raleigh, located just north of the College Park neighborhood. A local nonprofit, DHIC, purchased the property and redeveloped the entire site in phases with the assistance of more than $12 million from the City of Raleigh:

- The Villages at Washington Terrace (162 units for families),

- Booker Park North (72 units for the elderly),

- Booker Park South (68 units for the elderly), and

- Washington Terrace by Stanley Martin Homes (58 townhomes).

A final phase, Fisher Grove, is now underway and will create 166 more units for families with the help of a $4.9 million loan from the City.

Project Spotlight: East College Park

The City partnered with six builders to develop 98 single-family homes in East College Park, which is located less than a mile east of downtown. This mixed-income neighborhood ensures that 60% of homes are affordable to families earning under 80% AMI.

East College Park has been recognized as as strong model of homeownership in North Carolina, and received the 2022 Home Ownership Development Award from the North Carolina Housing Finance Agency.